Contents:

You can https://trading-market.org/ more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Formations are rarely perfect, which means there may be some noise between the respective shoulders and head. It isn’t wise to jump into a trade the moment you see a hammer. The simplest method of confirming a hammer is to see whether the previous trend continues in the next session. Sign up for a demo account to hone your strategies in a risk-free environment. Chart patterns should not be used in isolation, they should be used as a strong confirmation for the indications of other tools such as MACD, Support/Resistance, Fibonacci Retracement, etc.

Swatch Group AG (SWGAY) May Find a Bottom Soon, Here’s Why … – Nasdaq

Swatch Group AG (SWGAY) May Find a Bottom Soon, Here’s Why ….

Posted: Tue, 28 Mar 2023 13:55:00 GMT [source]

Chart patterns are the basis of technical analysis and require a trader to know exactly what they are looking at, as well as what they are looking for. I can also search for stocks based on the most common chart patterns and technical indicators such as moving averages, candlesticks, Relative Strength Index , and more. This type of chart pattern indicates that prices can move in either direction depending on current market conditions and significant changes in trader sentiment. These chart reversal patterns can appear in both bull and bear markets.

However, they often signal the end of an existing trend and the beginning of a new cycle. A double top is a very bearish technical reversal formation that takes place after an asset reaches a high price twice in a row, with a modest decline between the two highs. When the price of an asset drops below a support level that is equal to or less than the low between the previous highs, it’s confirmed.

Uptrends occur when prices are making higher highs and higher lows. Up trendlines connect at least two of the lows and show support levels below price. Both patterns can be bullish or bearish, depending on the direction of the trend they occur in. When any of the patterns occurs in an uptrend, it is called a bullish pennant or bullish flag, as the case may be. In a downtrend, you can have a bearish pennant or bearish flag, as the case may be.

The ABCD pattern price action point D is the completion of each pattern before the market moves again. A double bottom pattern is a technical analysis charting pattern that characterizes a major change in a market trend, from down to up. Double top and bottom patterns are formed from consecutive rounding tops and bottoms.

What is a wedge formation?

But after putting in a decent high, the bulls settle back and give the bears some control into the close. Bulls were clearly in control during each session with very little energy from the bears. Just as the high represents the power of the bulls, the low represents the power of the bears. The lowest price in the candle is the limit of how strong the bears were during that session. In order to find enough demand to push through that resistance, the stock may need to consolidate lower until enough shares are accumulated.

These patterns are often used in conjunction with other indicators since rounding patterns in general can easily lead to fakeouts or mistaking reversal trends. To play these chart patterns, you should consider both scenarios and place one order on top of the formation and another at the bottom of the formation. In the traditional market top pattern, the stops are placed just above the right shoulder after the neckline is penetrated. Alternatively, the head of the pattern can be used as a stop, but this is likely a much larger risk and thus reduces the reward to risk ratio of the pattern. In the inverse pattern, the stop is placed just below the right shoulder. Again, the stop can be placed at the head of the pattern, although this does expose the trader to greater risk.

How to Learn Chart Patterns

Note the position of the stop loss in the middle of the pattern, above a mini-swing up. As the name implies, the double top pattern consists of two swing highs and a swing low between them. The stop loss can be kept below the head for entry at the right shoulder or below the right shoulder for neckline breakout entry.

The closer the 2 outer tops are to the same price, the more accurate the pattern. As a beginner to technical analysis, it can be overwhelming to know or remember all the different chart patterns; this is where a chart patterns cheat sheet can come in handy. A rounding bottom is a chart pattern in which price movements form the letter U and usually indicate a bullish upward trend. In comparison, a rounding top is a chart pattern whereby price movements on a graph form the shape of an upside-down U and signifies a bearish downward trend. A pennant is a continuation pattern represented by two trendlines that eventually meet. It is often formed after an asset experiences strong upward or downward movement, followed by consolidation before the trend continues in the same direction.

Today’s Indicators

Typically, trading volume will decrease during the pattern formation, followed by a significant increase during the breakout. Chart patterns, are becoming one of my favorites points of view in the market. Using this tools i become more aware of where i am in the market, the trend and where i can place correct entry’s Lets consider the difficulty of this structures. First i am not using individual lines in this chart, i am using tool bar channels.

In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information.

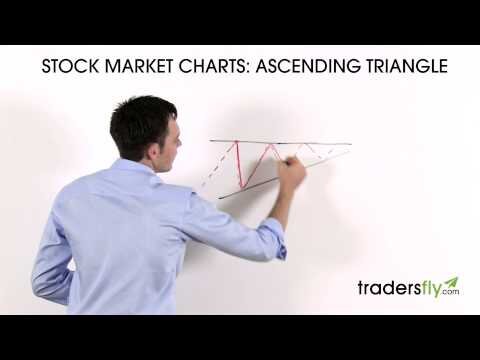

In this USDJPY chart below, you can see an ascending triangle in an emerging uptrend. A falling wedge is formed when the price moves between to descending trend lines with the upper trend line having a greater slope than the lower one. The rising wedge is formed when the price moves between two ascending trend lines with the lower trend line having a greater upward slope than the upper one. There are multiple chart formations; some are well known, while other formations or patterns traders may find on their own. Cory is an expert on stock, forex and futures price action trading strategies.

- Well done, you’ve completed Chart and candlestick patterns , lesson 1 in Technical analysis.

- As the father of candlestick charting, Honma recognized the impact of human emotion on markets.

- Chart patterns are one of the most powerful weapons to use in your battle with the markets.

- Unless otherwise indicated, all data is delayed by 15 minutes.

- A rounding bottom chart pattern can signify a continuation or a reversal.

- After all, he wrote the book that catapulted candlestick charting to the forefront of modern market trading systems.

For example, the price of Bitcoin has been steadily increasing. Chart patterns can indicate whether this rising price trend is about to switch course and start going down or continue in the same direction. This is characterized by a pause in the established trend and a subsequent move in the new direction as fresh energy surfaces from the other side.

As with all of these chart formation patternss, the goal is to provide an entry point to go long or short with a definable risk. In the example above, the proper entry would be below the body of the shooting star, with a stop at the high. In his books, Nison describes the depth of information found in a single candle, not to mention a string of candles that form patterns. We believe the best way to do this is by understanding candlestick patterns. You need to know how to read price action, how to spot them in real time, and how to trade them. In fact, most traders and investors never learn this lesson, and they end up getting burned over and over again.

Mastering your emotions is the difference between success and failure in the market. But once you do, you can profit handsomely from it for the rest of your life. I personally use the Finviz stock screener because it offers advanced filtering capabilities that allow me to zero in on the most profitable setups in seconds. All you have to do is wait for the signal and then place the trade when you find the right setup.

What Makes a Head and Shoulders Pattern Work?

Reversal patterns signal the end of the current trend and continuation patterns signal that the price trend is likely to continue in the same direction. Pictured above in the original chart is a normal breakout on a Inverse Head And Shoulders Pattern while the… The Head and Shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. It consists of 3 tops with a higher high in the middle, called the head. The height of the last top can be higher than the first, but not higher than the head. In other words, the price tried to make a higher high, but failed.

The ABCD pattern is a simple chart pattern that is comprised of two equal price legs. The ABCD consolidation pattern forecast is when a stock’s price is going to change direction. Depending on the orientation, the same pattern may indicate either a bullish or bearish reversal. The magnitude of the subsequent rise was similar to the initial spike of $22,000. Double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter “W” or “M” .

These include the popular bar charts and candlestick charts, as well as line charts and point and figure charts. The W pattern is the most notorious pattern because it shows up inside every pattern. Every consolidation pattern, continuation patterns and reversal patterns.

As a result of the constant growth in the crypto industry with the first emergence of Bitcoin and Ethereum, traders… The heikin ashi is a Japanese candlestick-based charting tool that is a more modulated version of the traditional candlestick charting… Double top and bottom formations are highly effective when identified correctly. However, they can be extremely detrimental when they are interpreted incorrectly. Therefore, one must be extremely careful and patient before jumping to conclusions.